Accounting For Cryptocurrency

Cryptocurrency is a type of digital currency that is based on cryptography. Properly accounting for these transactions in gaap financial statements is an emerging area as this trend continues.

What You Need to Know About Cryptocurrency AccountingWEB

What You Need to Know About Cryptocurrency AccountingWEB

In addition, in may 2018, cpa ontario issued a paper, navigating the brave new world of cryptocurrency and icos, which explores the emergence and development of cryptocurrencies and initial coin offerings.

Accounting for cryptocurrency. Accounting for cryptocurrency is not something to take lightly. Cryptocurrency and blockchain technology aren’t merely disrupting how we conduct business, but the demands on the accounting and finance industry as well. What is cryptocurrency accounting software?

Making sense of virtual currency. Certainly, this throws a whole new monkey wrench into basic accounting platforms and raises a few questions. The first full accounting system for crypto.

Calculating your tax obligation on your cryptocurrency investments is not something you want to risk — mistakes are expensive! Any business accepting this emerging payment method has a lot to learn. Learn the very basics of what cryptocurrency is.

With the appropriate design in place, it becomes easier for users to understand and navigate the features on the site. This alert discusses the accounting for cryptocurrency, which is a new type of value and payment method that is distinctly different from fiat currency. In this article, i will focus on accounting for cryptocurrencies only, because the accounting for tokens depends on their purpose and terms and it can (and in most cases will be) different from cryptocurrencies.

The rapid rise of cryptocurrency transactions has left governments around the world scrambling to provide guidance for proper accounting and taxation procedures. Bringing in professional cryptocurrency accountants like founder’s cpa group is an excellent alternative. This requirement is crucial for the api integration section of the website, as it would determine how.

In fact, it takes a great deal of studying to effectively (and legally) handle bitcoin and other crypto. We recommend consulting with an accountant familiar with your business to evaluate how accounting principles should apply to the specifics of your situation. Understand the accounting treatment for a purchase of cryptocurrency.

Similar to cryptocurrency taxes, cryptocurrency accounting is an emerging area with no concrete guidance from regulators and lawmakers. Cryptographic assets, including cryptocurrencies such as bitcoin, have generated a significant amount of. Please click to access the publication on the cpa canada website.

Under the current us accounting framework, cryptocurrency is not cash, currency, or a financial asset; A cryptocurrency is a virtual medium of exchange. A discussion of possible approaches to accounting for cryptocurrencies under existing ifrs;.

As use of cryptocurrency grows in popularity, it presents challenges for accounting of which vendors and their accountants will need to be aware. Learn what the proper tax treatment is and your obligations. Thus, they need to account for this source of money and possibly pay tax on it.

How is cryptocurrency handled by a bookkeeper, and just what in the world is it anyway? Understand what happens in accounting when you sell cryptocurrency. This is a preview of the financial reporting alert.

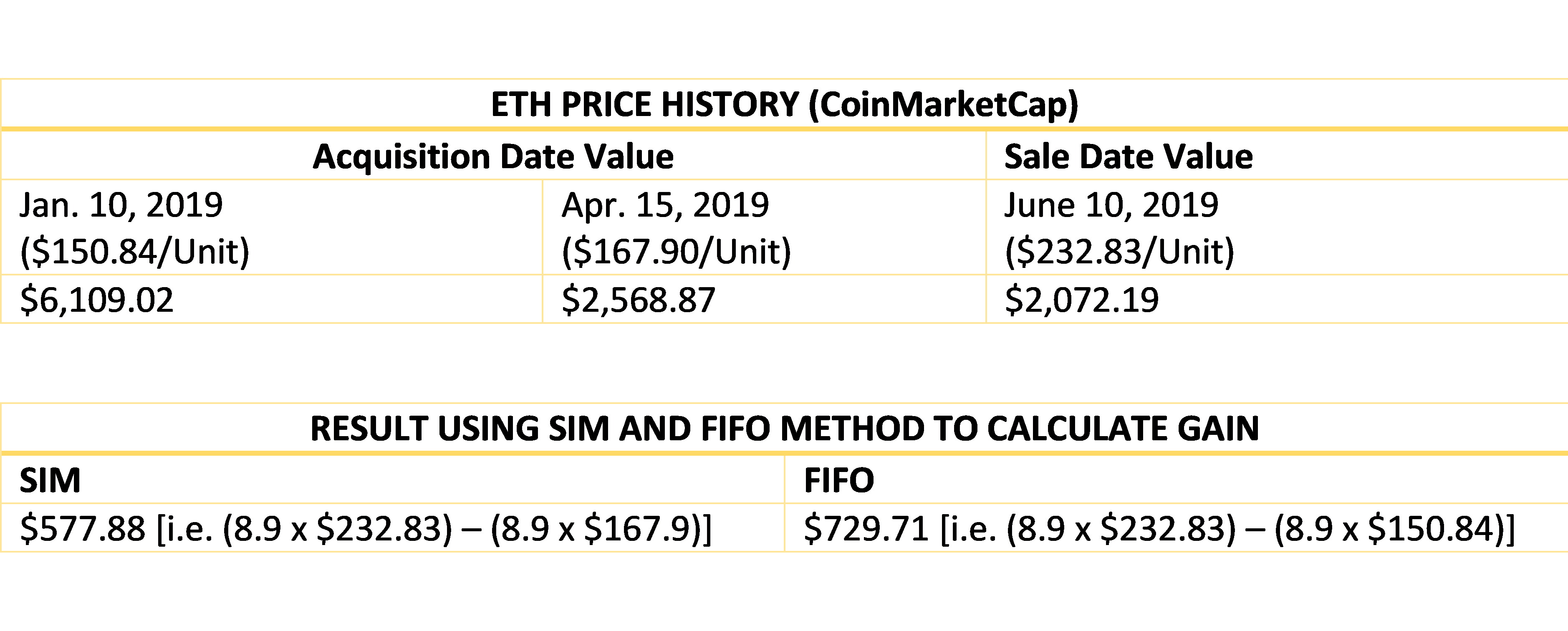

One of the most popular ones is bitcoin. Buying, selling and transacting between more than one cryptocurrency essentially layers multiple calculations of cost bases, fair market values, adjusted cost bases, gains and losses on top of each other. Cryptocurrency accounting software platforms must implement simple and intuitive designs that improve user experience.

What accounting standards might be used to account for cryptocurrency? Accounting for cryptocurrency is harder when more than one cryptocurrency is involved. Accounting standards board (aasb) has submitted a discussion paper on “digital currencies” to the international accounting standards board (iasb), and the accounting standards board of japan (asbj).

Cryptocurrency is a digital “currency” designed to function as a medium of exchange. Tips, requirements & best practices. Besides making transactions using this type of currency, people also make money with cryptocurrency.

It works in many ways the same as paper money, although cryptocurrency has no physical form. Cryptographic assets and related transactions: Cryptocurrency is a medium of exchange, created and stored electronically in the blockchain.

Here is the definition of cryptocurrency from techopedia: Ledgible tax pro is designed for tax professionals with clients who have investments in cryptocurrency. Another cryptographic asset (most commonly, a cryptocurrency such as bitcoin or ether).

Understand the accounting treatment for gains and losses on your cryptocurrency. The implication of this model is that declines in the market price of cryptocurrencies would be included in earnings, while increases in value beyond the original cost or recoveries of previous declines in value would not be captured. In exchange, the developer might issue (or.

There are still no cryptocurrency specific gaap rules. The softwares always support bitcoin, ethereum, litecoin, defi and nearly any other coin. At first, it might appear that cryptocurrency should be accounted for as cash because it is a form of digital money.

View the complete financial reporting alert. However, cryptocurrencies cannot be considered equivalent to cash (currency) as defined in ias 7 and ias 32 because they cannot readily be exchanged for any good or service. This guide will help you get started.

Cryptocurrency Accounting Resources GBA Global

Cryptocurrency Accounting Resources GBA Global

How to Account for Cryptocurrencies in line with IFRS

How to Account for Cryptocurrencies in line with IFRS

Cryptocurrency Accounting for Investment Funds U.S. GAAP

Cryptocurrency Accounting for Investment Funds U.S. GAAP

Getting started with Cryptocurrency Tax Accounting

Getting started with Cryptocurrency Tax Accounting

Accounting For Cryptocurrency YouTube

Accounting For Cryptocurrency YouTube

Cryptocurrency Accounting for Investment Funds U.S. GAAP

Cryptocurrency Accounting for Investment Funds U.S. GAAP

US Tax Filing Season Here is a Guide to Reporting Your

US Tax Filing Season Here is a Guide to Reporting Your

Cryptocurrency Accounting A Boon for the Future of

Cryptocurrency Accounting A Boon for the Future of

Pin by Vamshi Vangapally on cryptocurrency

Pin by Vamshi Vangapally on cryptocurrency

How to Account for Cryptocurrencies in line with IFRS

How to Account for Cryptocurrencies in line with IFRS

EveryTrade Cryptocurrency accounting GENERAL BYTES

EveryTrade Cryptocurrency accounting GENERAL BYTES

Cryptocurrency Merchant Account for Business Wellcoinpay

Cryptocurrency Merchant Account for Business Wellcoinpay

Top 5 Cryptocurrency to invest in 2018 Cryptocurrency

Top 5 Cryptocurrency to invest in 2018 Cryptocurrency

Simple How To Transfer From Coinbase to another

Simple How To Transfer From Coinbase to another

Accounting for Cryptocurrency Tips, Requirements & Best

Accounting for Cryptocurrency Tips, Requirements & Best

Cryptocurrency Accounting and Bookkeeping Experts

Cryptocurrency Accounting and Bookkeeping Experts

Accounting For Cryptocurrency Pwc CryptoCoins Info Club

Accounting For Cryptocurrency Pwc CryptoCoins Info Club

Ethereum Cryptocurrency ethereumCryptocurrency

Ethereum Cryptocurrency ethereumCryptocurrency

Comments

Post a Comment